PA Tax Credit Programs

Many local businesses and individuals choose to redirect their Pennsylvania income taxes to Erie Day School, directly funding our Scholarship Programs. These contributions are some of the most impactful donations we receive—often larger in size and recurring year after year. Even better, participating in these programs keeps your tax dollars in our local community, supporting students right here at EDS instead of elsewhere in the Commonwealth.

For Individuals

If you receive a paycheck, you may be eligible to donate your PA Personal Income Tax to Erie Day School and receive a 90% state tax credit. This program requires a two-year commitment and is facilitated through a Special Purpose Entity (SPE), such as the Central PA Scholarship Fund.

For Business Owners

Businesses can also redirect their PA Business Tax to Erie Day School and receive a 90% state business tax credit. This program is administered by the Commonwealth of PA Department of Community & Economic Development (DCED) and requires a two-year commitment.

Key Application Dates:

-

May 15: Deadline for returning applicants

-

July 1: Application opens for first-time applicants (early submission recommended—credits are awarded on a first-come basis and can run out quickly!)

Business Application & Timeline

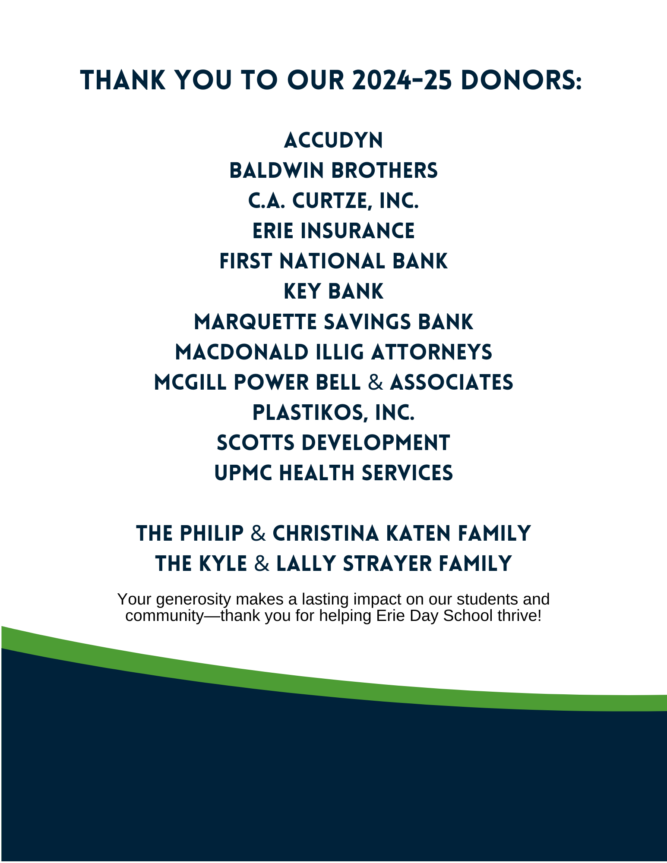

To make a tax-deductible donation or for additional information, contact Christina Katen, Director of Development at ckaten@eriedayschool.com.